Introduction

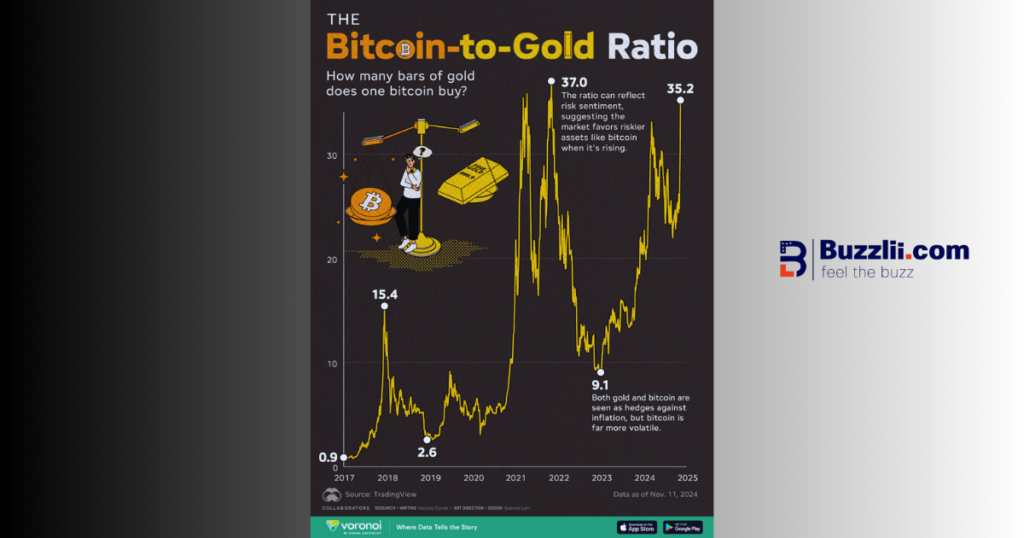

Global financial markets are seeing a noteworthy divergence, with gold and silver continuing to soar as Bitcoin shows symptoms of uncertainty. Precious metals have regained popularity among investors seeking stability, while the cryptocurrency market is consolidating following months of rapid movements. This move has been a hot topic in financial media, trade forums, and online conversations.

The comparison is important since gold, silver, and Bitcoin are frequently compared as alternative assets. Each responds differently to inflationary expectations, interest rates, and overall economic uncertainty. When commodities climb while Bitcoin remains flat, it raises crucial issues about risk appetite, market confidence, and where capital may move next.

This essay delves into why gold and silver are gaining momentum, why Bitcoin price consolidation is dominating crypto discourse, and how current crypto market volatility is impacting investor behavior without resorting to speculation or hype.

Gold + Silver are pumping to new highs while Bitcoin is still stuck below $90k.

— Ash Crypto (@AshCrypto) December 27, 2025

I think BTC is not lagging, it’s just a temporary decoupling and it’s telling us where confidence really is right now.

Gold & silver:

-Macro fear hedges

-Central banks & traditional capital

-Slow,… pic.twitter.com/2eHxpcft7a

Gold and Silver Rally Gains Momentum

Why Precious Metals Are Rising

Gold and silver prices have risen amid rising macroeconomic uncertainties. Investors frequently resort to precious metals during times of currency weakness, geopolitical tension, or altering monetary policy assumptions. Recent market behavior indicates that many traders are reconsidering metals as dependable stores of value.

Gold has traditionally been regarded as a buffer against inflation and currency risk, whereas silver benefits from both its monetary and industrial uses. The confluence of these reasons has fueled the recent gold and silver boom, drawing interest from both institutional and retail investors.

Investor Sentiment Around Metals

Market sentiment indicators indicate an increase in demand for physical metals and related investment products. Analysts have noted that metals benefit from their long-standing reputation for stability, particularly during times of uncertainty in risk assets.

This increasing interest has fueled debate about asset allocation, especially when compared to digital assets like Bitcoin.

Bitcoin Price Consolidation Takes Center Stage

Bitcoin Struggles to Regain Momentum

While metals are rising, Bitcoin has entered a phase known as Bitcoin price consolidation. Following earlier significant rises, Bitcoin’s price has moved inside a rather limited range, with successive efforts to break higher losing momentum.

This sideways movement does not necessarily signify weakness, but it does reflect the market’s reluctance. Traders are attentively monitoring technical levels and macroeconomic indicators to decide the next move. Discussions across trading platforms indicate that many participants are waiting for more specific catalysts before committing to substantial positions.

Bitcoin Price Today and Market Psychology

The current Bitcoin price indicates a balance between buyers and sellers. On the one hand, long-term investors seem hesitant to sell forcefully. On the other hand, new buyers are wary, especially given the larger financial turmoil.

This equilibrium has contributed to lower volatility than previous times, even though short-term price movements continue to draw traders’ attention.

Bitcoin vs Gold: A Renewed Comparison

Different Roles in a Shifting Market

The continuous comparison of Bitcoin and gold has reappeared, with metals outperforming cryptocurrency in recent sessions. Gold’s long history as a store of wealth stands in stark contrast to Bitcoin’s relatively brief history, which has included moments of tremendous volatility.

Bitcoin supporters frequently highlight its fixed supply and decentralized nature, whereas gold enthusiasts emphasize its stability and universal acceptance. The current situation demonstrates how different assets react to market stress.

Capital Rotation and Risk Appetite

Some analysts believe that a portion of the current metals boom is due to capital shifting out of higher-risk assets. When uncertainty rises, investors frequently minimize their exposure to volatile products, which can have a short-term impact on cryptocurrency.

This shift does not necessarily indicate a long-term shift in preference, but it does highlight how susceptible digital assets may be to overall market mood.

Crypto Market Volatility Remains a Key Factor

Uneven Performance Across Digital Assets

While Bitcoin consolidates, the overall cryptocurrency market continues to fare unevenly. Some digital assets make quick movements, while others lag. This climate has made the cryptocurrency market volatile, even when Bitcoin trades sideways.

Traders are closely monitoring liquidity circumstances and macroeconomic data, which frequently influence short-term price behavior in the cryptocurrency market.

XRP Price Drop Highlights Market Caution

While Bitcoin consolidates, the overall cryptocurrency market continues to fare unevenly. Some digital assets make quick movements, while others lag. This climate has made the cryptocurrency market volatile, even when Bitcoin trades sideways.

Traders are closely monitoring liquidity circumstances and macroeconomic data, which frequently influence short-term price behavior in the cryptocurrency market.

What Is Driving the Divergence?

Macroeconomic Influences

Interest rate expectations, currency patterns, and global economic signals all have a significant impact on asset performance. Precious metals typically benefit when trust in fiat currency dwindles, whereas cryptocurrencies frequently adapt to liquidity conditions and investor risk tolerance.

Recent data has boosted commodities, while cryptocurrency markets are waiting for more signs to fuel further growth.

Short-Term Uncertainty, Long-Term Questions

The recent divergence demonstrates how various asset classes react in uncertain times. Bitcoin’s recovery is fading due to a combination of cautious attitude, technical obstacles, and broader financial conditions, rather than a single issue.

This atmosphere motivates investors to reconsider their time horizons and risk exposure.

Key Insights and Practical Takeaways

- Gold and silver benefit from their status as protective assets.

- Bitcoin price consolidation indicates market hesitancy rather than outright decline.

- Comparisons between Bitcoin and gold continue to dominate investment discourse.

- The cryptocurrency market remains more volatile than traditional asset classes.

- Movements like the XRP price decline reflect the continued caution in digital markets.

- These insights help readers comprehend why markets are responding differently across asset classes and why diversification remains a popular issue in financial discourse.

Conclusion

In my Views, The current market landscape demonstrates a stark difference between the strength of precious metals and the reluctance exhibited in cryptocurrency. As gold and silver climb, Bitcoin struggles to regain pace, entering a period of stabilization that reflects greater uncertainty rather than a clear trend.

This discrepancy emphasizes the necessity of understanding how different assets react to shifting economic situations. While metals benefit from stable demand, Bitcoin and the broader crypto market face volatility and fluctuating sentiment. As markets evolve, these characteristics will continue to influence how investors perceive risk, value, and opportunity.

Frequently Asked Questions

To Read More : Ravens Defeat Packers 41–24 as Derrick Henry Dominates

To Read More :Kyle Whittingham Brings Decades of Coaching Experience to Michigan Football